FTX saga continues…

Well the FTX fallout continues. We’ve learned some new details, like what their balance sheet actually looked like. Liabilities are customer deposits. As you can see from below, it’s not surprising that FTX had issues when people started wanting their deposits back. The liabilities greatly outweighted liquid assets. Illiquid assets are hard to sell on short notice and at full value, so all that can cover customer deposits ($9B) in the short term are liquid assets ($900M). $9B is a lot bigger than $900M.

Other companies continue to put out reassurances. Some have announced pauses on withdrawals. It will be a long time until the industry recovers from this impact.

But I think it’s also important to remember that technology that powers crypto, blockchain, will continue to forge ahead. Crypto is just a small use case.

Money & Crypto

The Taylor Swift ticket debacle on Ticketmaster last week highlights some of the issues with tickets. There’s been rumblings about Live Nation and Ticketmaster being a monopoly and exerting too much control, which I get because it’s crazy how many fees you incur when buying tickets. There’s a great John Oliver episode about it from earlier this year. (Isn’t it amazing how John Oliver seems to be ahead every issue?!)

Elizabeth Holmes, of Theranos fraud, is sentenced to 11 years in prison

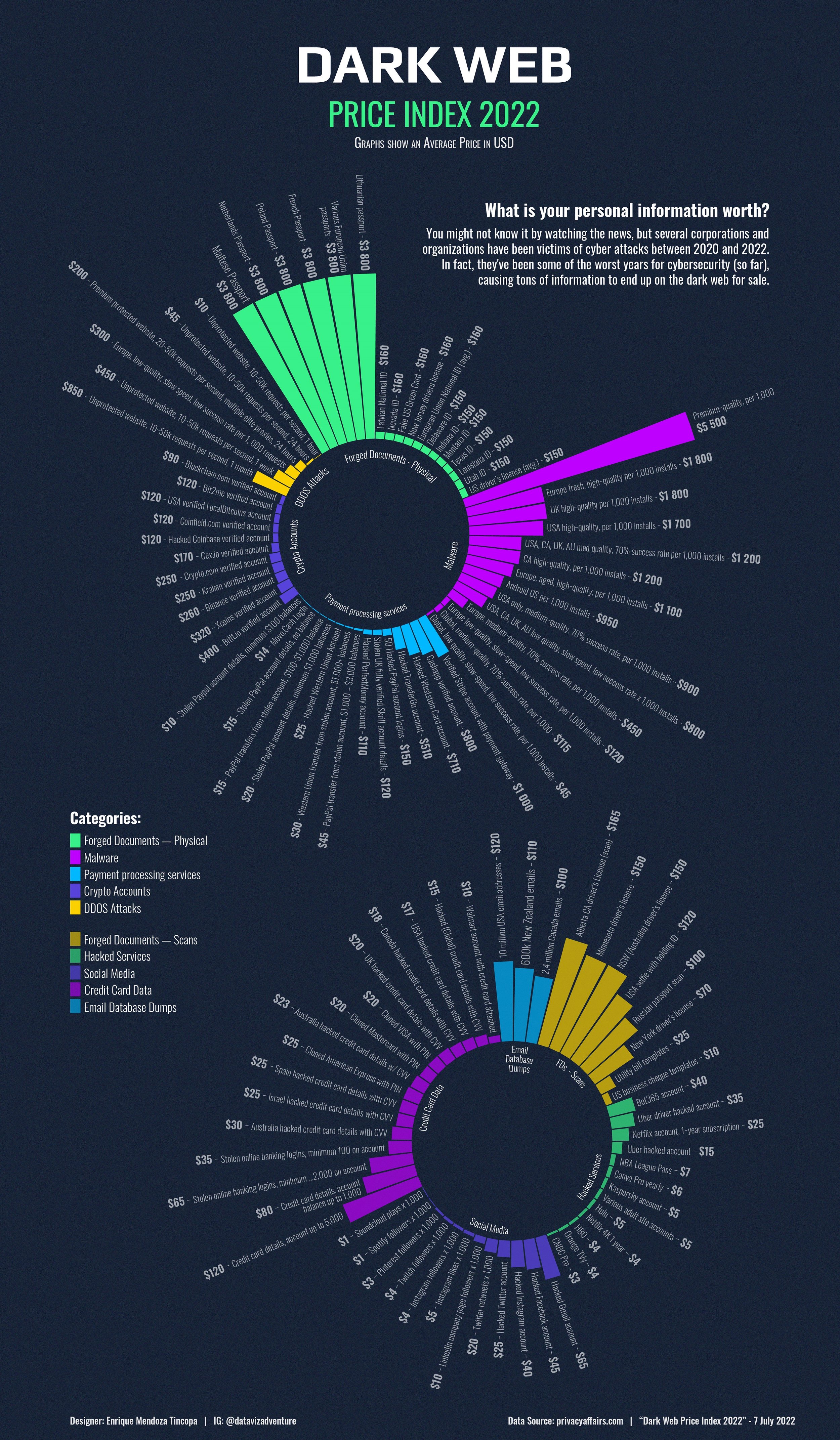

This is kinda amazing. Someone on Visual Capitalist tracked the price of different things on the dark web. Would not have guessed that physical documents go for the most!

Who is Caroline Ellison, CEO of Alameda, who had helped run the company with SBF?

Matt Levine, Bloomberg columnist, wrote a great piece analyzing the problems with MoviePass’s money business. (I meant to include it last week but got sidetracked with FTX. His coverage of FTX has been excellent btw.).

He writes “There was a period in the late 2010s when it was fashionable to think that the way to build a successful company was by losing money on every transaction. You would create a desirable product, offer it at an uneconomically discounted price, and get lots and lots of customers very quickly. This growth in customers — even money-losing customers — was the point. That growth would, for one thing, attract lots of venture-capital investment, because VCs seemed to care more about rapid customer growth than they did about unit economics.”

This is exactly what is coming to haunt a lot of startups. They built on growth and not profitability. In economic downturns, you can’t rely on funding as your source of profitability anymore, and it’s going to take out a lot of businesses.

Etc.

Why everything looks the same? Once you read this article, you can’t unsee how a lot of products and marketing all looks the same. The author calls it ‘blanding’ and it is EVERYWHERE.

Alcohol banned last minute at World Cup and World Cup pictures so far

Grammy’s nomination list announced

Reader Feedback

Email walletstreetpodcast@gmail.com to share your questions/comments.

Disclaimer: All opinions are my own. The content on this site and on the podcast does not constitute financial, legal, accounting, tax, or investment advice.